Loan Officer Assist

Product Design | User Research | Visual Design

The Problem

Loan officers and loan processors are always context switching. Their daily tasks range from data entry to calling title companies. Our workforce users needed a one stop shop for all of their mortgage tasks. They needed a place to upload documents, add employment and income, and send contracts to home buyers.

Project Goals

Make it easy for loan officers to capture important personal data.

Provide a powerful tool to find the right loan products in demanding market.

Make it simple for loan officers to upload documents and send disclosures.

The Team

Promontory MortgagePath | Denver, CO

Tony Lardie | Senior Product Designer

Ema C. | Product Manager

Lora R. | Engineering Manager

My Role

I lead design sprints, interviewed clients and loan officers, conducted user moderated sessions, created the design system, worked with engineers on new components, crafted the user flows, designed the new experience and ensured ADA accessibility was met for all interactions.

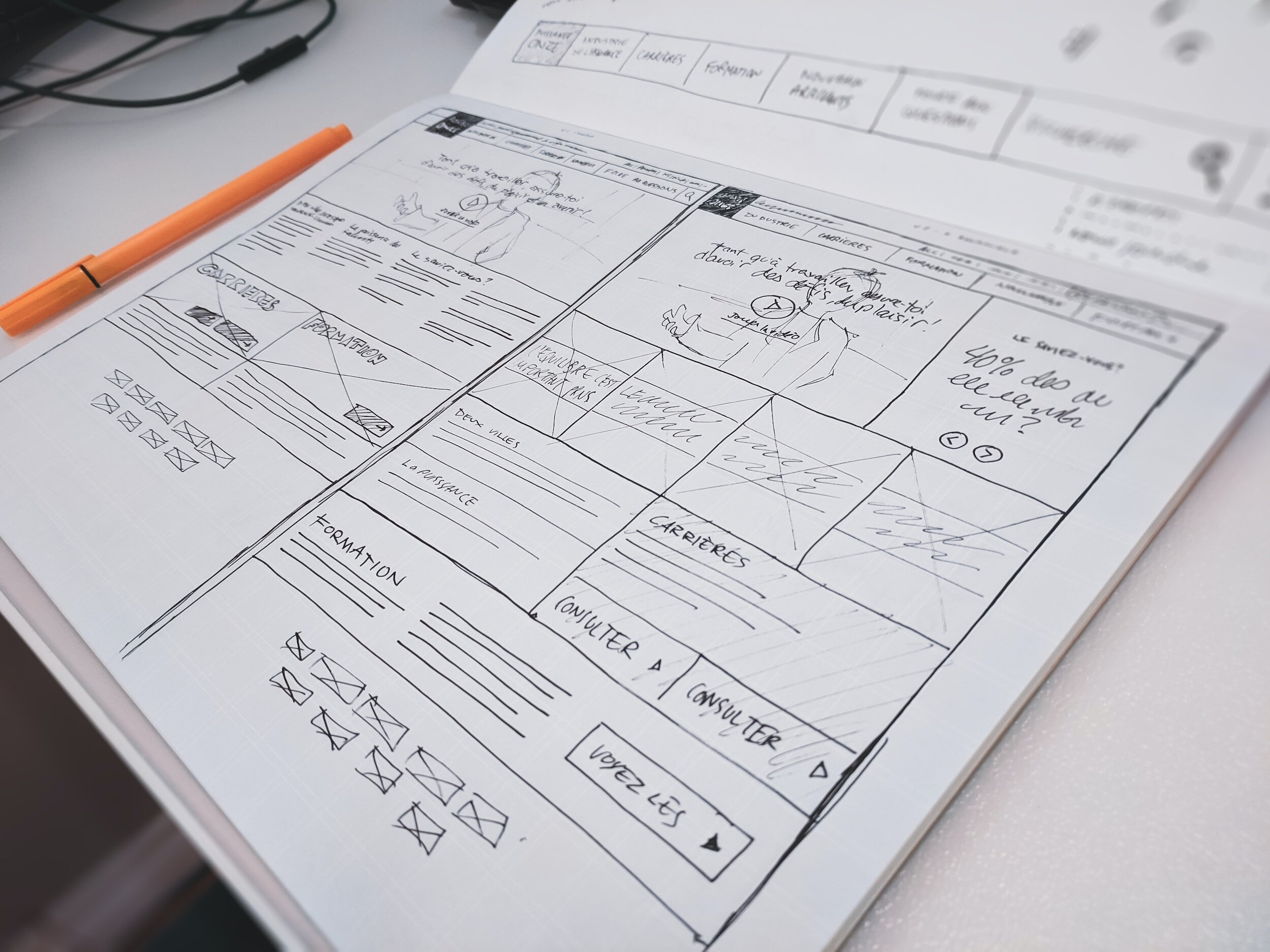

Discovery

Lead design sprints with mortgage insiders and subject matter experts.

Conducted user interviews with loan processors.

Researched other mortgage solutions to evaluate our position in the market.

Visited with clients to review features and direction of our designs.

User Research Findings

Loan officers are busy and need a simple solution.

So many document to add, need a tool to share with home buyers.

Complicated employment and income date to calculate eligibility.

Ever changing rules and loan products to keep track of.

Service multiple loans at once, always juggling duties.

Security and privacy are key to protect personal data.

The Solution

I introduced a brand new single page application for loan officers to quickly enter personal data, a document center to upload and send documents and a powerful loan product tool to qualify home buyers.

Simplified Mortgage Application

Simplified the 1003 mortgage application .

Updated navigation to quickly add applicants, employment and assets.

Provided a help center to ensure home buyer data was correctly entered to speed up the time to close.

Gave loan officers a clear point to edit data and a simple view to read data.

Secure portal enter sensitive user data.

Robust Document Center

Powerful document center to add disclosure, loan packets and all the borrower files.

Two way communication to let borrowers know what documents were outstanding.

Docutech integration allowed loan officers to sign disclosure packets right in the site.

Merge functionality allowed loan officers to combine documents and make any necessary notes for processors to read.